Schedule a Demo touch-less invoice processing and approval routingĭocuments associated with the accounts payable processesĭepending on the scale of operations, the accounts payable procedures of a company may include many or all of the following documents: Set up touchless AP workflows and streamline the Accounts Payable process in seconds. These steps are essential to avoid errors and fraud in expenditure.

ACCOUNTS PAYABLE PROCESSING FULL

The full cycle of the accounts payable process includes receiving the purchase order (PO) from the purchase department, receiving the invoice from the vendor, matching/validating the PO and the invoice, approval final payment to the vendor. There may be intervening processes involving purchase orders, verifications, and approvals.

the number of vendors/service providers that cater to its needs.The scale of an organization's accounts payable processing workflow depends on: Schedule a Demo auto-collect documents into your AP workflow

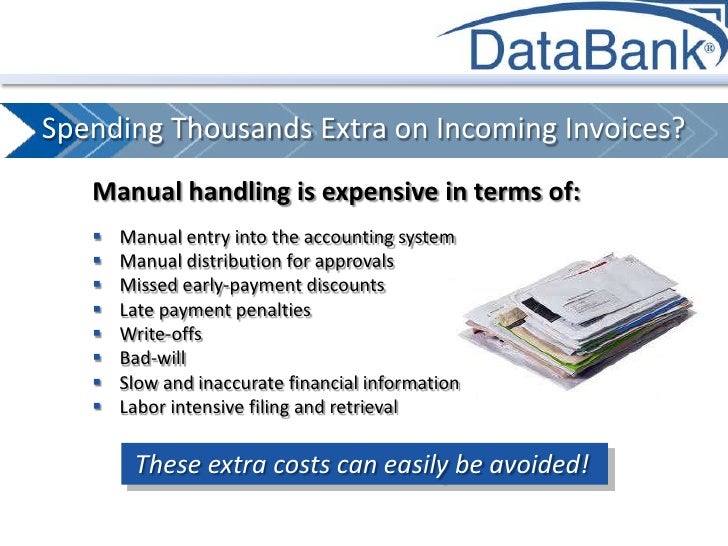

ACCOUNTS PAYABLE PROCESSING MANUAL

Looking to automate your manual AP Processes? Get a 7-day free trial to see how Nanonets can help your team implement end-to-end AP automation. The integration of internal controls in the AP process, especially in automated processes eliminates fraudulent or inaccurate payments while ensuring that all invoices are accounted for. It also helps better management of cash flow by enabling payments only when due, using the credit facility offered by vendors.AP processing eliminates fraud through stringent follow-up and checks at every stage of the procurement process.It consolidates all purchase actions for easy retrieval.It keeps track of the company’s needs and purchases, which helps avoid delays and interruption in the day-to-day functioning of the company.Accounts payable processing keeps overspending in check, and prevents multiple/duplicate payments for the same product/service.Prompt payments also prevent overdue charges, penalties, or late fees.It ensures prompt payment of bills, which is important for the creditworthiness of a company and helps establish healthy relationships with vendors.The management of accounts payable processes is critical to the efficient functioning of a business: To leverage early payments or dynamic discounts.To ensure that payments are legitimate and accurate.The AP maintains records of all financial aspects of purchases made by the company, which is crucial for auditing and tax purposes. The Accounts Payable process encompasses almost all payments (except payroll) made by a business for goods and services. Why is accounts payable management important? Modern approaches such as AP automation can help optimise & supercharge entire AP workflows and free up man-hours for higher value tasks.

This can involve lots of paperwork and man-hours spent reconciling details across invoices, POs & receipts. Businesses might even occasionally opt for accounts payable outsourcing. Most businesses have a separate AP department that handles all incoming bills/invoices and processes payments to vendors. The AP process is just one part of the entire procure to pay (P2P) process that covers all stages of activity from purchase requisition to procurement & vendor payments. The full cycle of the accounts payable process includes capturing invoice data, appropriate GL coding, a 3 way match of invoices, approving or flagging invoices and finally processing payments. The goal of the AP process is to ensure legitimacy and accuracy of any payment originating from the business to any supplier/vendor. Accounts payable processing ensures timely payments to suppliers and vendors. The accounts payable or AP is the amount of money that a business owes to its vendors/suppliers for availing their goods/services. The accounts payable process of a company is the management of its short-term payment obligations to vendors/suppliers.

0 kommentar(er)

0 kommentar(er)